Backtesting Trades with Optuna's Bayesian Optimization

Hello, I'm incompetent. While there was a certain joy in manually changing parameters every time, I became interested in backtesting trades and learned about Bayesian optimization, so I decided to try it. Also, a friend from the math department told me that it could be visualized as an SVM, so I'm making a note of it. A Thorough Explanation of Support Vector Machine (SVM) Theory and Implementation I got so engrossed that I realized my entire four-day summer vacation was gone (dead eyes).

From the Results

Conditions* Same period* Same technical indicators* 8000 parameter tuning trials* Long only

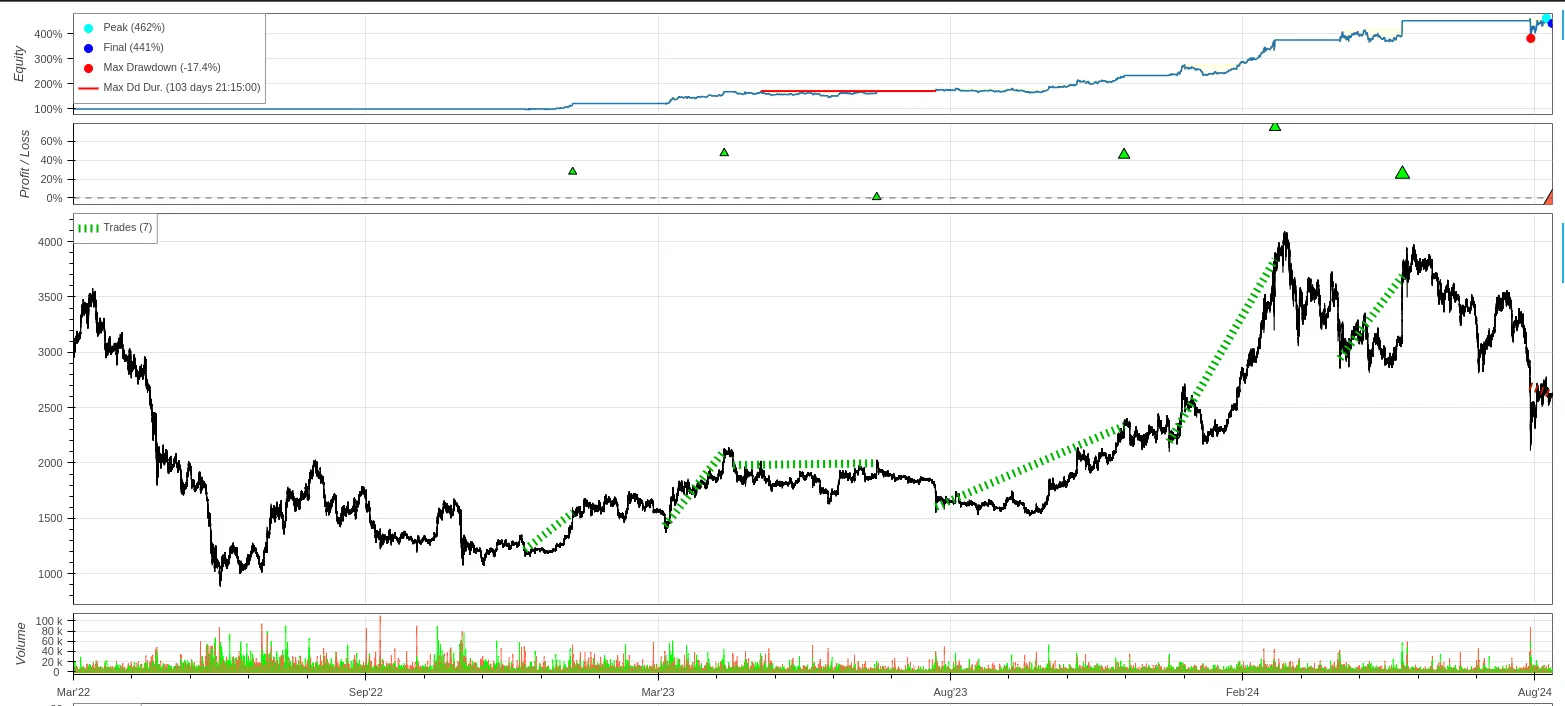

5-minute chart

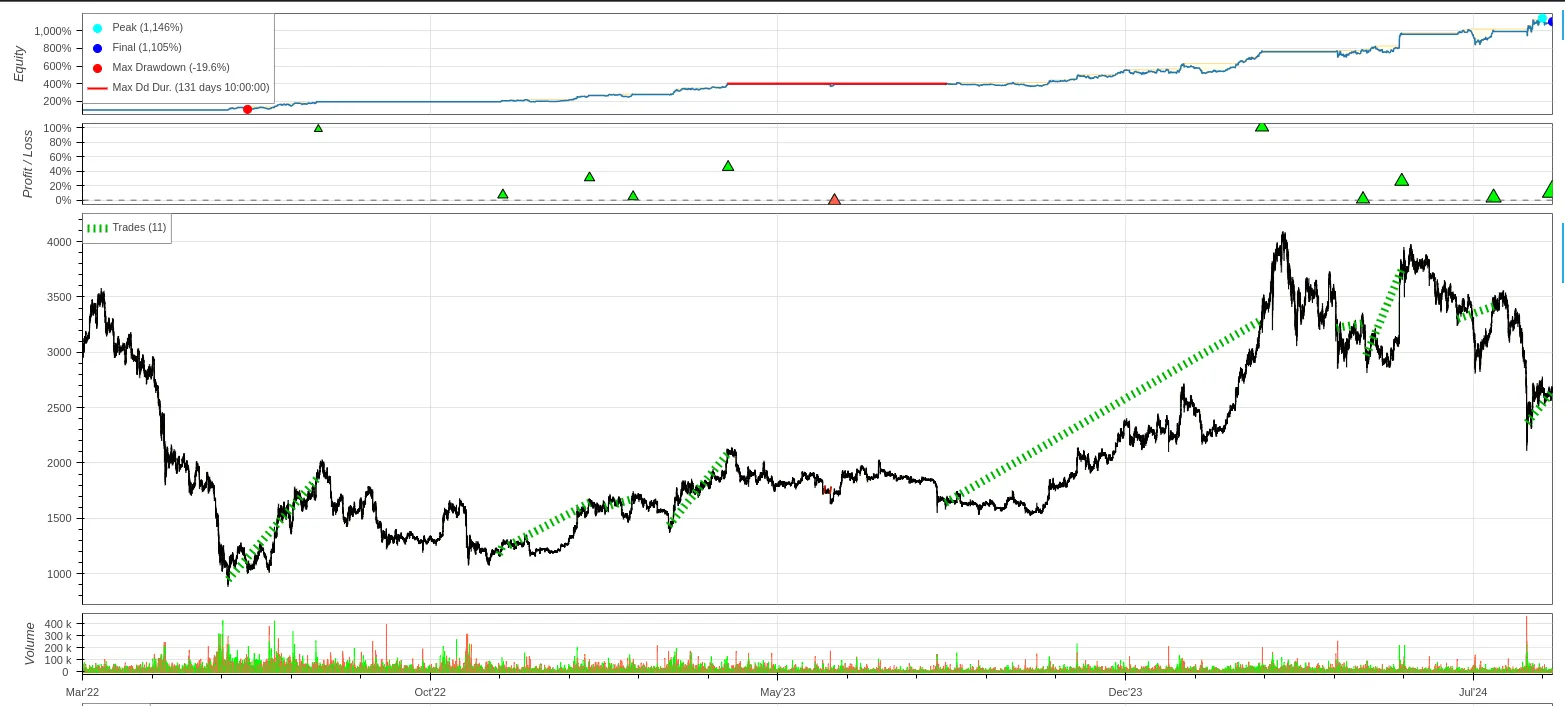

1-hour chart

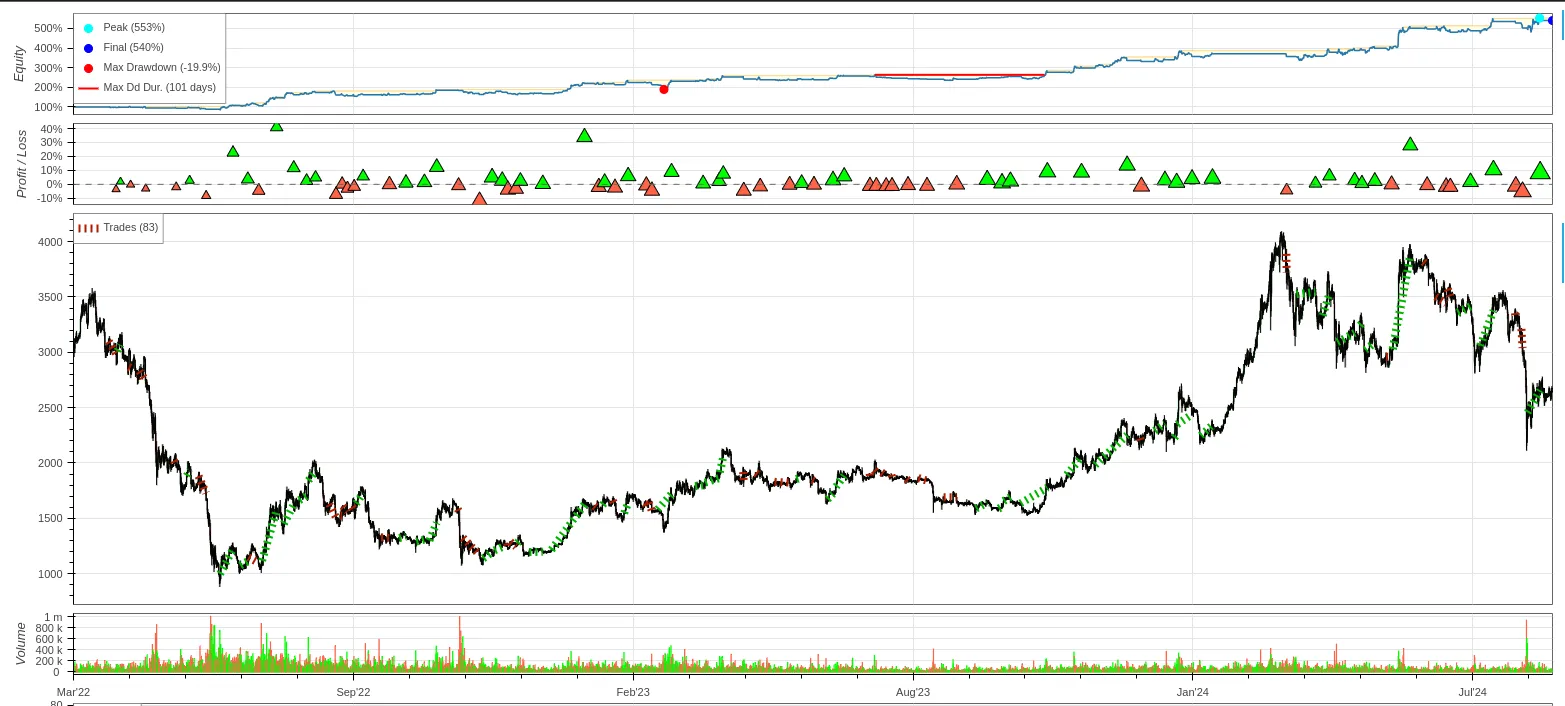

4-hour chart

That's an incredible profit!

Realistically

Technical indicators can be somewhat results-oriented, meaning their values might be a consequence of price movements.

However, seeing how it avoids taking buy positions during significant downtrends and only takes long positions in specific situations, there might be some useful indicators.

I felt that the way it conserved funds during a downtrend and took positions in the overall market was excellent. By the way, some people might think, "Bots are the strongest after all!" when they see this, but a Hokkaido University paper states that technical indicators are meaningless in markets driven by fundamentals, and ultimately, they don't make much difference.

In contrast, algo-trading has been considered powerful and adopted since the 1990s when speculator Victor Niederhoffer's brother was active as a Wall Street trader. More than 20 years later, it's possible that electronic devices, which seem to have more will than humans, are now dominating the market. That's all for now.

See you again.